What is the CAC40 (Paris Stock Exchange) ?

The CAC 40 is main stock market index of the Paris Stock Exchange. Created in 1987 it became effective from 1988 and has 1,000 basis points. This market index includes 40 French corporate securities representing every business sector. The index is managed by Euronext.

Meaning of the name

CAC stands for « Cotation Assistée en Continu (continuous quotation of a stock) », in other words a system where the trading price of a share varies continuously on weekdays between 9am and 5:30pm. The CAC is updated every 30 seconds.

40 means that 40 of the 100 largest French companies are represented.

Use of the CAC40

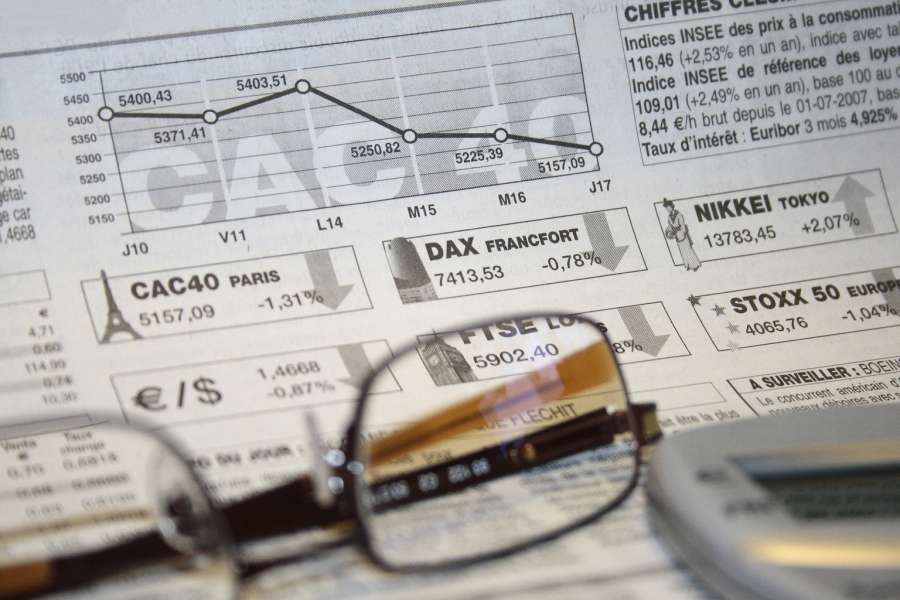

The performance of the CAC40 reflects the general trend of the shares of large French companies on financial markets. For this reason it is the most followed market index at the Paris Stock Exchange. When the CAC40 goes down the French economy is deemed to be in poorer health. Hence it is an essential index for markets, and closely followed worldwide as well.

Selection of companies included in the CAC40

The CSI (Conseil Scientifique des Indices-Index Scientific Board) meets several times a year to discuss whom to include in the CAC40. The Board is a group of independent experts, using criteria such as the volume of trades for a company and making sure every business sector is represented. The Board may decide to replace one stock with another, for many different reasons: the fall in a company’s market capitalisation for example, or the company’s liquidity shortage. Over 75% of companies included in the CAC40 have been renewed since 1988.

The Board also meets in case of exceptional financial operations such as the merger of two companies.

Share prices for companies entering or leaving the CAC40 often fluctuate sharply, because index fund managers re-allocate their assets to reflect the new composition of the CAC40. A company whose stock is newly included in the CAC40 will usually see its share price rise, and conversely the price goes down when it leaves the index.

CAC40 index calculation

The index is an average of values weighted by market capitalisation. The listing of shares of any member of the CAC40 can be suspended for 15 minutes if its value fluctuates by over 10%, then by twice 5% in the same direction. When this happens the security is said to be « reserved upwards » or « reserved downwards ». The weight of every company included in the CAC40 is linked to the number of securities available on the market. Weights vary from one company to another, depending on capitalisation and volume of trade. When a share price goes up, its weight inside the CAC40 increases.

Like the other major world indices, the CAC40 has been taking into account not only the market capitalisation of companies but also their free float, in other words the potential number of shares available on the market, since December 1st, 2003.

The highest level of the CAC40 since its inception was reached on September 4, 2000, at 6,944.7 points, thanks to the speculative bubble around telecommunications, media, and technology companies, and the lowest value was 893.80 points on January 29, 1988.

Annual returns of the CAC40 index have gradually mirrored those of the Dow Jones in recent years, revealing how major stock exchanges are becoming more and more interdependent.