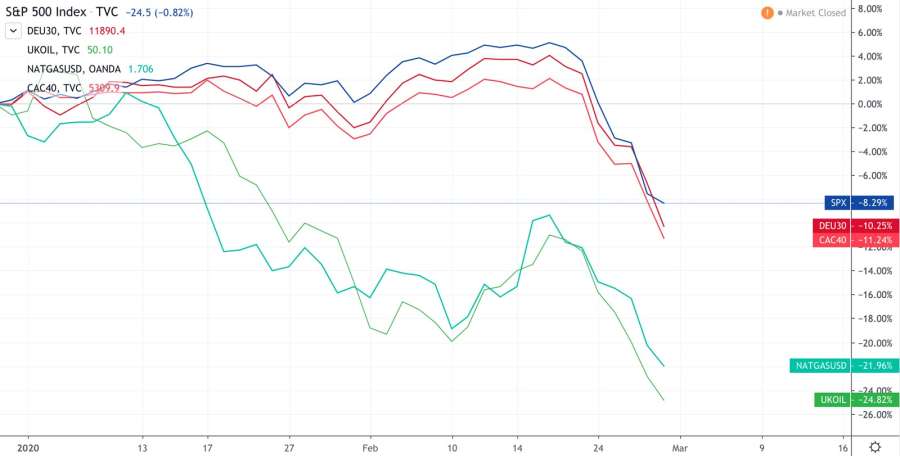

The last two weeks of February 2020 were emotional ones. The equity market collapsed, as did oil and gas, and other commodities. The direct consequences of the Coronavirus psychosis. Investors rushed to “safe havens”: assets such as gold, the Swiss franc or the US dollar and US 10-year treasury bond.

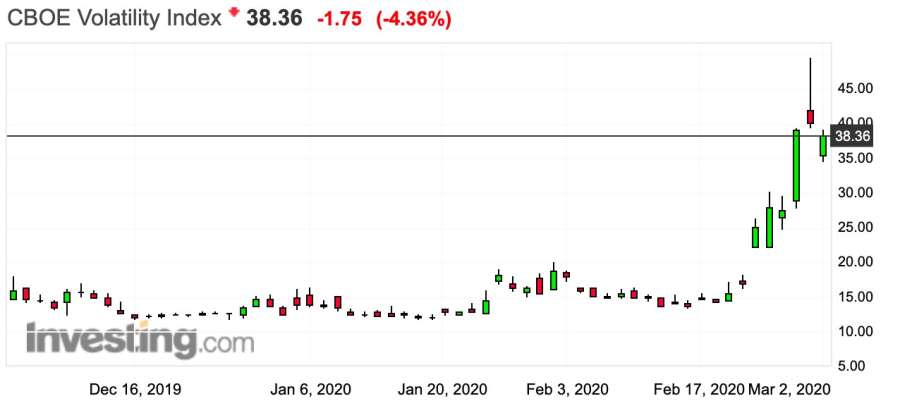

Uncertainty remains. Market volatility has exploded, as evidenced by the VIX (implied volatility of the S&P 500) that has reached a level we had not seen since 2011, with a peak at 49%:

Raw materials

A slowdown in economic activity and travel is bad news for both the prices of industrial raw materials (such as oil) and the companies that sell them. This is amplified because China, the epicentre of the crisis, is a large consumer of raw materials.

The question is whether the Coronavirus and its harmful effects to the Chinese economy are a brief and transient phenomenon, or whether we should be more worried about the months to come.

Gold rush and Swiss franc

Within the last 7 years, gold has peaked at almost $1,680. Similarly, the Swiss franc has gone up, slowly but surely. Both assets are classic safe havens when the economy is bad or when brutal shocks disrupt global financial markets.

The gold phenomenon is all the more psychological as it is reasoned and reasonable: gold produces no return and it is no coincidence that Warren Buffet believes gold is no match for equity markets. Investing in companies is much more profitable than simply owning gold.

Today, the risk for gold keepers would be for scientists to quickly find and distribute a vaccine against the Coronavirus. Stocks would rise up while gold would decline.

Our selection of verified and recommended brokers:

Here are the brokers that our experts have rigorously hand-picked and verified to help guide you towards your financial goals with confidence and peace of mind.

Quality customer service 🏆

Advantages

Minimum deposit: £0

Spreads: 0.5 pip on S&P 500, 1 pip on FTSE 100, 1 pip on CAC 40

Open and close your positions 24/5

Trading simulator with £10,000 virtual funds

Integration with TradingView and ProRealTime

Over 50 years of expertise

Recommended broker 🏆

Advantages

Min deposit: £10

Spreads: 0.1 pip on eur/usd and eur/gbp, 0.3 pip for the sp500 and 0.8 pip for the FTSE 100

Buy shares and ETFs with no commission

Online courses for investors of all levels

Demo account with £20,000 virtual funds

Ultra-low spreads 🏆

Advantages

Minimum deposit: £0

Spreads: 0.5 pip on EUR/USD, 0.45 pip on FTSE 100 and 0.8 pip on EUR/GBP and EUR/CHF

Over 20 years of experience

Fund protection up to 1 million GBP

Ultra-competitive spreads

Advanced chart analysis with TradingView

Bond recovery

Until recently, the US Federal Reserve was on hold. But futures markets are now confident that the Fed will lower interest rates further in order to support the economy.

This, coupled with a direct thirst for risk-free investment, has fuelled a new rally in US Treasuries. Rising prices have pushed yields, which are going the other way towards record lows. A similar rally is underway in some other developed markets which, like the United states, have not yet resorted to negative rates.

Coronavirus, not so serious?

Many professional market observers seem convinced that the Coronavirus will have been in our rear-view mirrors for a long time by the end of 2020.

This confidence is based on the following assumptions:

- The Coronavirus will not go beyond Spring or Summer;

- Repressed demand will largely compensate for the loss of economic activity at the start of 2020;

- If the epidemic continues, governments will rush to save the situation.

These hypotheses could all prove to be true. Indeed:

- Like most infectious diseases, the Coronavirus is more easily transmitted in cold weather, when people stay close to each other;

- The Chinese and world economies quickly recovered after SARS in the early 2000s;

- The Chinese government is already intervening to support its stock markets and provide relief to borrowers who would otherwise struggle to repay their loans;

- In addition, according to the recent report relating to the Federal Reserve’s January meeting, the Coronavirus is a risk to which it pays particular attention. This suggests the possibility of rate reduction.

Unless it’s the opposite

At the same time, this type of confidence could be misguided.

- It is far too early to predict outcomes for the Coronavirus. It is also much more damaging than SARS ever was.

- Manufacturing supply chains are complex, international and increasingly lean. If a component is missing, a factory compromised, there is no space on container ships or we are missing drivers for raw materials, market recovery will take time.

- In addition, there are few countries as connected to the world economy as China. It is the second largest economy in the world, with 16% of the world GDP. It is also the world’s largest exporter and the world’s second largest importer according to the World Trade Organisation.

- Finally, governments are ultimately limited in what they can do to jumpstart their economy. For example, world interest rates remain at historically low levels, many in the negatives. This largely rules out monetary policy as an option, forcing governments to use fiscal measures such as tax cuts or stimulus packages.

All this suggests that the market will not, at the very least, recover quickly.

Caution is advised

It is no longer certain that the Coronavirus epidemic will be a brief, brutal and controlled shock. Investors are now positioning themselves for more serious damage to economic growth and corporate profits.

With this in mind, responsible investors are trying to find ways to remain exposed to industries that are less dependent on raw materials, transportation and manufacturing, while protecting themselves by putting money into safe heaven assets, hence the record price of gold.

It is also important to remember a key lesson from the financial crisis: people want and must protect their own future and wealth. Even if gold produces nothing, it may be one of the few assets (or the only one?) that is immune to world markets’ turmoil.