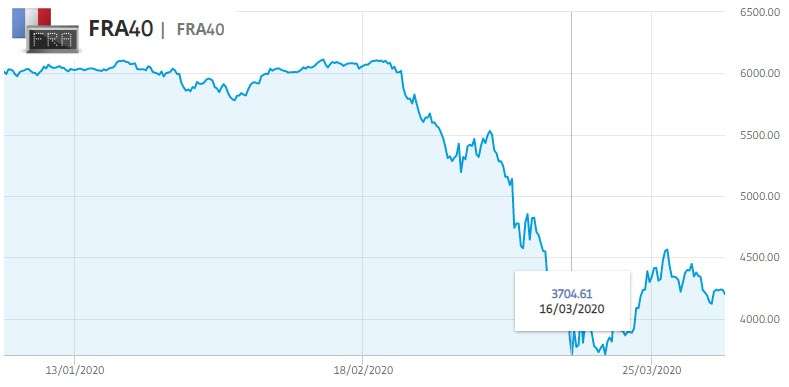

The 20% recession announced by economists on European and American markets in the first quarter of 2020 has thus far remained below previous economic crises. Have we really taken into account the magnitude of the coming situation or are we witnessing resistance from stock markets over the long term?

POLITICS/ECONOMY, A DOUBLE DISCOURSE

Faced with the collapse of a good number of stocks, it is often tempting to take advantage of the situation to do good business in the financial markets. On the one hand, politicians say that we are witnessing an unprecedented crisis, that an economic one is underway and that it will take over the health crisis we are currently experiencing.

On the other hand, stock markets seem reassured by the rescue plans for banks and businesses announced by governments in spite of a 450-billion-euro loss of market capitalization to speak only of the CAC 40.

SHOULD WE TAKE OUR CHANCES?

A feeling of confidence therefore seems to have taken hold of investors who are taking advantage of the situation to find good deals. Only, is the situation really at a low point or can it still plummet? No one seems to know for sure. Therefore, there are two strategies that I think can guide your investment decisions.

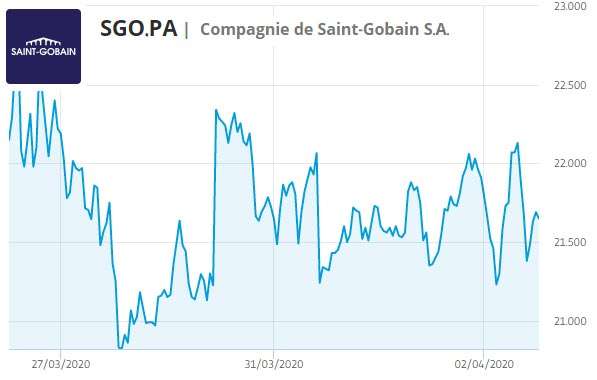

The first, although very binary, is to buy at the lowest level, whatever the sector, hoping that shares will only go up. However, we are also witnessing very high price volatility, + 4% one day, -4% the next if not more. This makes it hard to be certain. Risk-taking may nevertheless delight those who are a little frivolous and who like to expose themselves to risk… and it can work!

The second, more reasonable, strategy involves asking the right questions and investing in the short/medium term in key business sectors closely or indirectly linked to the health crisis. That’s what I’m doing!

HEALTH AND BIO TECH?

The health sector seems ideal. I have personally evolved in this sector for more than 6 years and more particularly in the pre-analytical sector. Uh... What are pre-analytics? To put it simply, pre-analysis includes all activities related to blood sampling. The manufacture of sampling systems in particular.

Our selection of verified and recommended brokers:

Here are the brokers that our experts have rigorously hand-picked and verified to help guide you towards your financial goals with confidence and peace of mind.

Quality customer service 🏆

Advantages

Minimum deposit: £0

Spreads: 0.5 pip on S&P 500, 1 pip on FTSE 100, 1 pip on CAC 40

Open and close your positions 24/5

Trading simulator with £10,000 virtual funds

Integration with TradingView and ProRealTime

Over 50 years of expertise

Recommended broker 🏆

Advantages

Min deposit: £10

Spreads: 0.1 pip on eur/usd and eur/gbp, 0.3 pip for the sp500 and 0.8 pip for the FTSE 100

Buy shares and ETFs with no commission

Online courses for investors of all levels

Demo account with £20,000 virtual funds

Ultra-low spreads 🏆

Advantages

Minimum deposit: £0

Spreads: 0.5 pip on EUR/USD, 0.45 pip on FTSE 100 and 0.8 pip on EUR/GBP and EUR/CHF

Over 20 years of experience

Fund protection up to 1 million GBP

Ultra-competitive spreads

Advanced chart analysis with TradingView

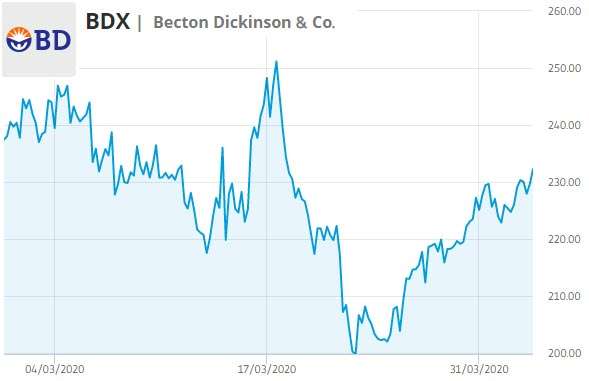

There are only 2 major players in the world. The Austrian Greiner Bio-One (company not listed on the stock exchange) and the American Becton Dickison (BDX) traded on the NYSE. BDX employs more than 49,000 people in 50 countries and generated a $17.29 billion revenue in 2019. The virological tests that everyone is talking about will require a very large number of blood samples worldwide and unrivalled demand for sampling tubes in the short term. BDX factories are currently operating at full capacity in anticipation of future orders!

Proof of this is the surge in shares which register an average growth of 3% per day after a significant fall linked to the announcement of partial confinement in the United States.

In my case, my BDX equity portfolio increased by 26.11% in just a week, my best performance since I started trading!

It also seems that Sanofi (SASY.PA) stocks should be watched. Indeed, the company has indicated through its chief executive that it will be able to produce several million doses of hydroxychloroquine based on future clinical results.

In short, the current situation forces us to remain vigilant about future developments. In my opinion, prudence, reflection and moderation in investments are the best steps to take in these uncertain times. To be continued.