CFD overview

CFD stands for Contract For Difference. It is a financial contract between two parties, one being the « buyer » and the other the « seller ». The seller pledges to pay the buyer the difference between the price of an underlying asset upon subscription of the contract and its price at a future date. If the difference is negative it is the seller who will collect the difference from the buyer.

Thus, a CFD is a financial derivative which allows you to bet on the downward or upward fluctuation of a share price or a financial index (or, less frequently, a currency or commodity), without ever having to buy anything.

How do CFDs work?

How do CFDs work?

CFD trading means buying or selling a certain number of units, depending on how you anticipate the rate of a given product will perform, if it will rise or fall.

For every point the rate goes in favour of the buyer, his gain is the number of units chosen multiplied by the number of points the underlying asset price changed. For every point the rate moves against his prediction, the buyer makes a loss, and the seller collects the difference.

CFDs are unregulated financial derivatives with no time limit.

Types of CFDs

CFDs allow you to make profits linked to the price fluctuation of an underlying asset. This underlying asset can be a share, an index, a commodity or a currency.

With currencies, the term Forex (Foreign Exchange) trading is used, which is the highest volume financial market. But you can also trade CFDs on shares, for example the CAC40 or other stock indices. When the underlying asset is a share, the contract amounts to an equity derivative allowing investors to speculate on market rate fluctuation without having to buy or own a share.

CFDs are also available on gold, silver, petroleum, or any commodity offered on financial markets.

CFD trading is open to individuals using the services of specialised brokers and their online trading platforms. Brokers are paid a commission on every transaction, such as the spread (difference between the purchase price of a product and its selling price), or a maintenance margin for long-standing positions. There is no limit to the number of CFDs which can be bought or sold.

Strategies for trading CFDs

The value of a CFD is directly linked to the value of the underlying asset.

There are two options for taking a position on a CFD:

If you think the price of the underlying asset will go up, then you will decide to buy a CFD. This is called going long. You can then sell the CFD some time later to make a profit if the underlying asset has indeed increased in value (or conversely you make a loss).

If you think the price of the underlying asset will go down, you must short-sell the CFD (sell it before you have bought it). You are going short. You then buy the CFD some time later to make a profit if the value of the underlying asset has indeed decreased (or conversely you make a loss).

Once you have bought and sold (in whatever order) your position is said to be flat.

There is no time limit for CFDs. You can hold on to your position as long as you wish and choose when you sell.

In any case, it is wiser to « buy rumours, and sell news » . In other words, if prices are rumoured to be rising, do not wait for confirmation to take a position, and thus make interesting profits.

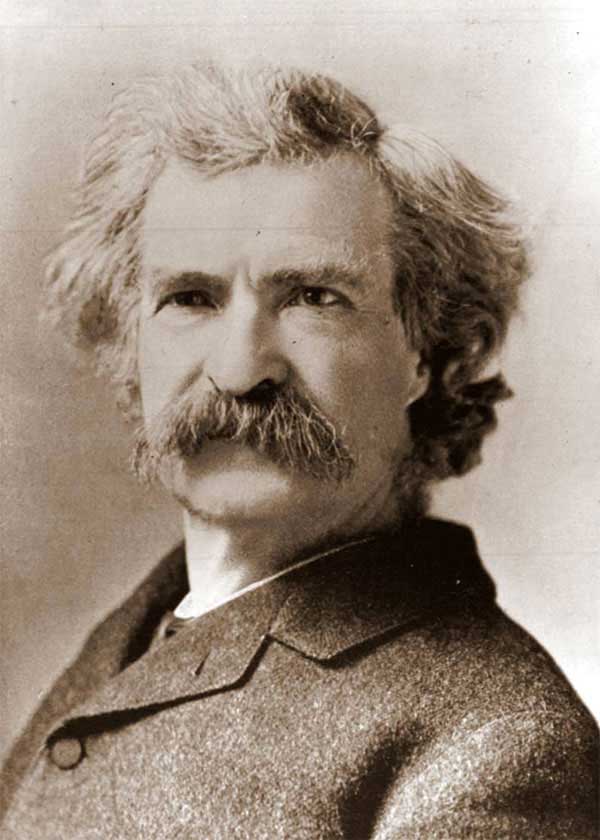

When trading CFDs you will also benefit from the leverage effect, which means you can spend much more money than you really have in your account. The leverage effect allows you to considerably increase your profits, but you also run the risk of increasing your losses considerably, and even to lose more money than you originally started with. As the American author Mark Twain said regarding stock market risk:

When trading CFDs you will also benefit from the leverage effect, which means you can spend much more money than you really have in your account. The leverage effect allows you to considerably increase your profits, but you also run the risk of increasing your losses considerably, and even to lose more money than you originally started with. As the American author Mark Twain said regarding stock market risk:

"October is a very dangerous month to speculate on the stock market. But there are other dangerous months: July, January, September, April, November, May, March, June, December, August, and February".

Risk is the name of the game.

How are CFDs traded ?

CFD trading is open to anyone. You need to use the services of a specialised broker, usually online. They are paid a commission on each transaction. These costs reduce your gain on each transaction (or potentially make your loses heavier).

Most brokers automatically update your account daily if you leave a position open for more than one trading day. So, if your investment is making a profit, the broker will credit your account on each trading day. Conversely, he will debit your account daily.

You can buy or sell as many CFDs as you wish. You can also use the leverage effect, in other words take a position for more money than you have available (for example: 20 times more). The system allows you to make far greater profits but you also risk making far greater losses, and potentially losing more money than you had to start with. You must be very aware of this risk. And as the investor is asked to leave a certain amount in his account to cover for the leverage effect, he may be asked to add to his account depending on market fluctuation for his investments.