IN THE TRADER FAMILY, I WOULD LIKE THE BEGINNER! GREAT PICK!

Let me introduce myself, my name is Thomas. I am what you can call a novice, a padawan or a young trading wolf. Basically, I have landed in a universe that, at first glance, seemed exclusive to insiders and finance professionals. As a 30-year-old community manager, launching into the unknown is a challenge, and yet...

In my articles, I will share my discoveries, my successes and my failures. We will discuss my latest findings and I will also share my feelings about this new discipline which I am sure has great success in store!

WHY DID I START TRADING?

You will have understood that, on paper, finance and me were not meant to be... However, without realizing it, we are constantly asked for news related to finance. Press, radio, internet or television, we absorb economic news daily! One day, my ear was particularly focused on one of them; the initial public offering of La Française des Jeux (France’s national lottery).

A few days later, I heard reports that over 800,000 investors had already purchased securities of the company. "Already?” I asked myself. And why not me? With a bitter feeling, that precise moment clicked. Are there really 800,000 professional traders in France? Are 800,000 competent people trained in trading methods? The answer is no!

WHERE TO START?

So here I am with this sudden desire to be one of the few thousand lucky people who own part of our national heritage. I started my research online by typing "buy FDJ stocks". The result is a multitude of trading platforms offering solutions that are all more efficient and secure than the others. First step, make a choice, make a decision, trading has already started.

As far as I was concerned, I opted for the etoro platform. Why? At first because of its accessibility and quickness of use. I also watched some advertisements on Youtube with the message "With etoro, your banker does not receive commission fees". I therefore assumed all the other platforms had compulsory commission fees... This was a quick (and most likely false) assumption but that was enough for me to make my decision.

Our selection of verified and recommended brokers:

Here are the brokers that our experts have rigorously hand-picked and verified to help guide you towards your financial goals with confidence and peace of mind.

Quality customer service 🏆

Advantages

Minimum deposit: £0

Spreads: 0.5 pip on S&P 500, 1 pip on FTSE 100, 1 pip on CAC 40

Open and close your positions 24/5

Trading simulator with £10,000 virtual funds

Integration with TradingView and ProRealTime

Over 50 years of expertise

Recommended broker 🏆

Advantages

Min deposit: £10

Spreads: 0.1 pip on eur/usd and eur/gbp, 0.3 pip for the sp500 and 0.8 pip for the FTSE 100

Buy shares and ETFs with no commission

Online courses for investors of all levels

Demo account with £20,000 virtual funds

Ultra-low spreads 🏆

Advantages

Minimum deposit: £0

Spreads: 0.5 pip on EUR/USD, 0.45 pip on FTSE 100 and 0.8 pip on EUR/GBP and EUR/CHF

Over 20 years of experience

Fund protection up to 1 million GBP

Ultra-competitive spreads

Advanced chart analysis with TradingView

In short, after a few legal verifications (identity card, income estimate and buyer profile) I was thrown into the deep end with the firm intention of buying FDJ shares.

MY FIRST TRADE

This is it. With a trembling hand, palpitating heart and the feeling of fulfilling my ambition, I have finally decided to invest in my first actions.

Here is what you will face while investing on etoro. I do not pretend to know everything but here is what I have understood.

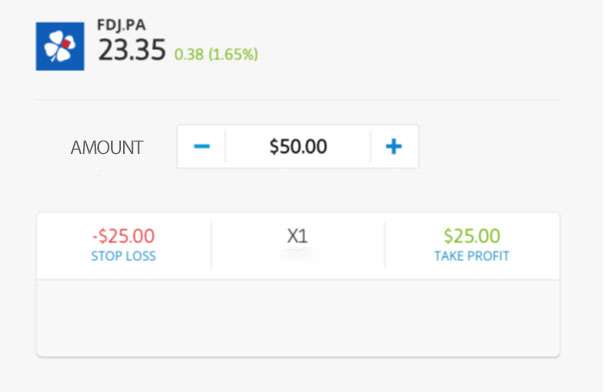

In the top left corner is the share price in euros. Here, it’s €23.35. I had acquired it for €21.95. My first victory: its value increased! I digress... To the right of the share price is its evolution, in point and percentage (+0.38 / 1.65%). On the far right is a drop-down menu for immediate investing or to open an order. Opening an order allows you to position yourself at the desired price to buy a share or to invest when the market opens. You usually open an order if you think the stock will go down. For example, you would indicate buying a share if it goes below €23.20.

The amount is the value in € that you wish to invest in this share. You can express it in € or in units. For example, if you want to buy 2 FDJ shares, this amounts to investing €23.35 x2, i.e. €46.70.

At the bottom left corner, the STOP LOSS indicates the level at which you should consider separating from the action so as to cut your losses. In this case, if my initial investment loses €25, the stock will be sold automatically. Alternatively, the TAKE PROFIT indicates the level or amount from which you want to sell your share and make your first profits. In both cases, it is possible to change and/or delete these two indicators.

Finally, leverage. In insider language, it refers to the use of debt to increase investment capacity and the impact of this use on the return on invested equity… To put it simply, leverage allows you to multiply your exposure to a financial market by immobilizing only part of your capital, the other being directly lent by your trading platform. This can be very positive but also extremely negative in the event of a sudden drop in the share. We will come back to this notion in a future article – while I get a little more acquainted! Anyway, for a first trade, a leverage of 1 seemed reasonable and not too risky to start with.

AND NOW?

Here I am now officially a shareholder of La Française des Jeux! You just have to wait for the right time to sell the stock. You can opt for two separate strategies. Scalping, which involves selling the stock quickly once it goes up in order to make quick profits; or waiting in the longer term to reap even more profits. I opted for the latter.

As you can see, trading is available to everyone and all budgets. Your risks are limited to your initial contribution and the Stop Loss function acts as a real firewall, protecting you from any possible bankruptcy. Finally, most platforms also offer a virtual portfolio that will allow you to make fake investments in stocks and familiarize yourself with this new discipline. If I can do it, you can too! Watch out for the next article…