Here we go again!

Bitcoin has just dropped back below $100,000 and, as always during sharp moves, a part of the market is panicking. Yet nothing that is happening should really surprise investors who have been following the cycles for years.

The same scenario repeats itself: excessive optimism, oversized leverage, chain reactions and media headlines announcing the “end of the bull run”. A familiar pattern for anyone who was around in 2017, 2021… and even long before.

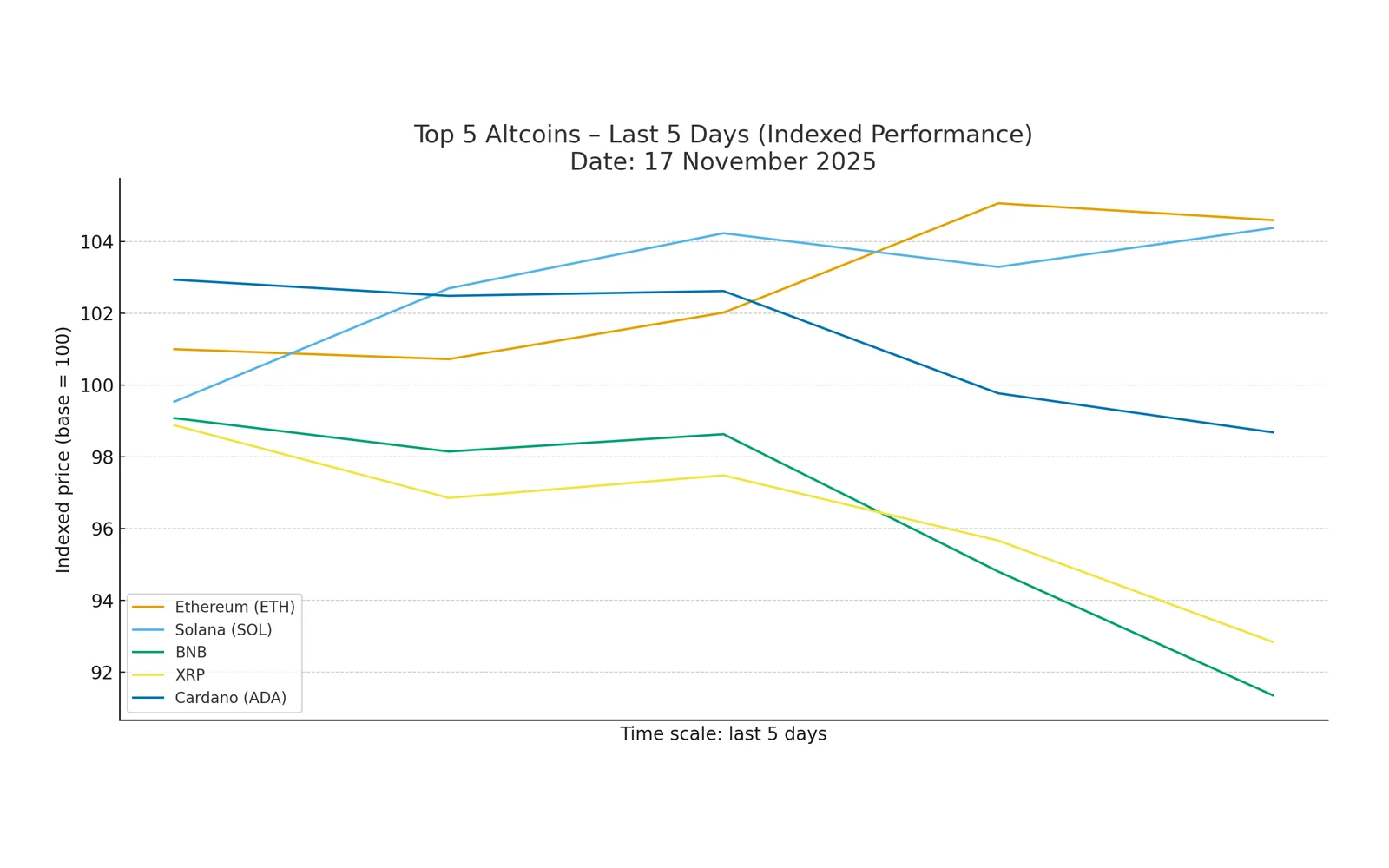

Once again, the movement affects the whole market. Bitcoin pulls back, Ethereum cools down, and many altcoins are falling much deeper. But this decline is far from irrational: it reflects a set of mechanisms that are perfectly typical of consolidation phases.

💡 Did you know?

Since 2018, more than 70% of Bitcoin’s daily trading volume has come from institutional players. This shift explains why current market movements are far more related to global liquidity and professional strategies than to retail traders.

Also worth reading: Which platform should you use to buy cryptocurrencies?

Bitcoin: key points to understand the current drop

Before analysing the current decline, it is essential to recall what Bitcoin really is. As the first cryptocurrency created in 2009, it remains today the backbone of the market and still represents a major share of total crypto capitalisation. Its decentralised structure, limited supply and open technology make it a unique asset, radically different from traditional currencies.

Technically, Bitcoin is built on a public blockchain — a distributed computing infrastructure that prevents fraud and operates without any central authority. This architecture continues to attract institutional investors who see Bitcoin as a scarce, programmable and censorship-resistant asset.

Since its inception, Bitcoin has alternated between strong expansion phases and sharp corrections. This is entirely normal for a volatile, young asset now integrated into global economic dynamics.

Why has Bitcoin fallen below $100,000?

The current decline is far from dramatic. It is the result of several factors which, combined, create a domino effect. One major element is leverage: many traders over-expose themselves expecting a perfectly linear rise. A tiny pullback is all it takes to trigger automatic liquidations, forcing sales and amplifying the downturn.

Another key factor is the psychological level of $100,000. For months, this threshold has acted as a liquidity magnet. Markets naturally gravitate around high-activity zones, and the more a level is tested, the weaker it becomes. The latest drop simply shows that this support eventually gave way after multiple retests.

Finally, the broader environment matters. Traditional markets are currently in a cautious phase, with investors reducing exposure to risk — mechanically affecting volatile assets such as Bitcoin. This is not a sign of Bitcoin weakness, but a synchronisation effect with a more nervous macro environment.

Key elements behind the current pullback

- ✅ Excessive leverage triggering forced chain liquidations.

- ✅ The $100,000 zone over-tested and too fragile to hold.

- ✅ Global risk-off sentiment weighing on all volatile assets.

- ✅ Lack of buyer reaction on a major psychological support.

- ✅ Liquidity hunting by large market players.

A crypto market under pressure: what investors must understand

Another, more subtle phenomenon is also at play: psychology. Many investors are too “zoomed in” on intraday fluctuations. They view a -5% move as a major signal, when it is merely normal noise in this type of market. With a broader perspective, these movements look far less dramatic and fit within a still-intact long-term trend.

We also need to mention overexposure. When a position becomes too heavy in a portfolio, every variation feels dramatic. This emotional pressure often indicates that the strategy is no longer aligned with risk tolerance. The market naturally shakes out excesses, just as it always has.

Finally, market manipulation is not to be ignored. Crypto remains one of the easiest markets to move for players with large capital. Sharp moves often aim to trap overconfident investors, trigger liquidations and reclaim positions at better prices. Ironically, the moments when the crowd is most stressed are often those where opportunities strengthen.

« Markets don’t reward perfection, but patience. Those who withstand the shocks capture the long-term trends. »

Crypto in 2025: regulation, institutions and the macro shift

Since 2018, the crypto landscape has changed dramatically. Regulation has matured, the ecosystem has professionalised, and institutional investors now play an increasingly dominant role. Traditional investment products linked to Bitcoin are multiplying, reinforcing their influence on market cycles.

At the same time, global monetary policy remains a major driver. The end of the tightening cycle, expected rate cuts and the gradual return of a more favourable environment for risk assets all point to long-term trends rather than short-term noise.

These changes are shaping a much more mature market compared to 2017 or 2021. Bitcoin is no longer just a speculative asset but a component of global finance, reacting to the same cycles of caution and expansion as traditional markets.

What has radically changed since 2018

- ✅ Clearer regulation across most developed countries.

- ✅ Massive entry of institutional investors.

- ✅ Traditional financial products based on Bitcoin.

- ✅ More mature market with less chaotic volatility.

- ✅ Macro integration: Bitcoin now reacts as a global asset.

💡 Key takeaway

Bitcoin’s pullback is not due to structural weakness but to a mechanical combination of liquidations, liquidity hunting and synchronisation with traditional markets. A logical pause within an overall bullish cycle.

Bitcoin: what can we expect next?

Predicting the future is difficult, but several elements make the situation far less worrying than it appears. Every bull cycle has been marked by major corrections, sometimes deeper than this one, before moving on to new highs. Bitcoin has always progressed in bursts: accumulation, shakeouts, acceleration, then consolidation. Nothing abnormal in today’s movements.

Historically, areas where liquidity is absorbed often become new launch points. Once excesses are cleared, the market regains a healthier structure, and upcoming levels — whether $108,000, $120,000 or higher — become accessible again if momentum returns.

Altcoins remain closely tied to Bitcoin’s leadership. They only regain real strength when Bitcoin stabilises above stronger support zones. Until the leading cryptocurrency fully regains momentum, altcoins will continue to experience more extreme volatility.

Key points to watch in 2025

#1 – Liquidity remains one of the most important indicators. It determines the speed of moves, tension points and break zones. Supply and demand have always been the main market engine, despite increasingly sophisticated analytical tools.

#2 – Regulation remains central. While it provides clarity, it can also introduce constraints. Recent developments show, however, a broad movement towards more formalisation and recognition of the sector, which tends to reassure institutional players.

#3 – Professional fund flows are crucial to monitor. Their influence on cycles continues to grow, and their strategies — slower but larger — act as a stabilising force… or an accelerating one depending on the context.

#4 – Blockchain technology continues to evolve, and not all cryptocurrencies will survive. The market will naturally favour robust projects with real utility in an increasingly competitive environment.

Bitcoin, however, retains its unique status: a scarce asset, robust infrastructure, growing institutional adoption. Nothing suggests a structural weakening, even when short-term volatility appears impressive.

The stage is set. It is now up to investors to identify, in this cleaner landscape, which projects will stand the test of time and benefit from the deeper trends reshaping the ecosystem.

Our analysis of the crypto market in 2025

The current decline does not change Bitcoin’s long-term trajectory. The market is rebalancing, clearing excessive leverage and preparing for a new expansion phase. Institutional players remain buyers, fundamentals are intact and the macro environment is turning more favourable.

As always, the ability to withstand the turbulence is what separates opportunistic investors from long-term winners.